About Agnes | From Ad Exec to Gann Educator. My Unlikely Journey.

I design courses that make W.D. Gann’s complex methods straightforward, usable, and practical. Before this, I spent years in 4A advertising agencies - my first and last job was at Ogilvy. Then I took a sharp turn into the world of trading. For over a decade, I’ve been deep in the trenches, decoding Gann’s riddles while trying to build my nest egg.

Ever felt like giving up on trading? I have.

I’ve made plenty of mistakes, felt completely alone, and spent way too many hours glued to my laptop. I’ve started and stopped more times than I can count—small wins, big losses, and a few scams from so-called “trading mentors.” The truth? Most of them never traded. They just sold dreams.

That’s why I clicked with Khit.

I wasn’t even planning to attend his seminar - just went to support a friend before moving to the U.S.

This is exactly why I connected with Khit. During that seminar, I had a light bulb moment: I had spent years trying to master every technical indicator without ever stepping back to see the bigger picture. Take Moving Averages — they only “work” when the market is already trending. And RSI? It only works in a choppy, sideways market. That was the turning point for me.

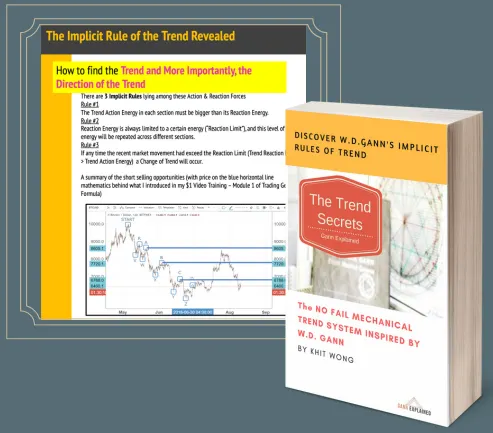

Because here’s the truth: price itself moves according to a universal law.

After that seminar, I picked up Khit’s Trend Secrets book, which is rooted in Gann’s Form Reading method. It revealed how market moves are governed by the same kind of natural laws that Newton described in his laws of motion - only here, they apply to price action instead of falling apples. That insight hit hard. And it changed everything.

No more chasing Static Astro Patterns.

Khit went on to explain why most Astro Trading doesn’t work: traders are obsessed with fixed correlations between planets, aspects, and sensitive points. But Gann’s real edge came from understanding mathematical patterns behind market behavior, not ±3° orbs or static planetary pairs. If you’re not profitable yet, stop guessing and start with mathematics. That was the message that lit the fire in me again.

Why we started Gann Explained

Before meeting Khit, I took private lessons from a former Wall Street trader, enrolled in expensive courses

I tried everything from mathematical trading, Butterfly patterns to Fibonacci ratios. None of it gave me certainty. Everything involved guesswork. But with Khit, I saw something different, systems that revealed repeatable cycles, clear entry points, and actual structure. So I joined forces with Khit to co-create Gann Explained. My background in advertising taught me how to craft stories, connect dots, and build systems. I now use those skills to design courses that guide traders step by step, so they don’t waste years in the dark like I did.

Getting Started is Easy

Step 1. A New Start: Trade with a New Lens

A fresh approach on Market Cycles, News, and Mercury Retrograde. See the market like never before!

Step 2. Learn & Apply: Gann BEACON Trading Room

Reduce screen time, gain insights, and watch your trading transform.

Disclaimer: Khit Wong and all members of Gann Explained LLC are NOT financial advisors, and nothing they say are meant to be a recommendation to buy or sell any financial instrument. All information is strictly educational and/or opinion.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and not professional advice. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and education and does not constitute advice. The brand name of Gann Explained LLC, will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. You are solely responsible for the use of any content and hold Khit Wong, Gann Explained LLC and all members harmless in any event or claim.

FTC DISCLOSURE: Any income claims shared by my students, friends, or clients are understood to be true and accurate, but are not verified in any way. Always do your own due diligence and use your own judgment when making buying decisions and investments in your business.

Gann Explained may express or utilize testimonials brokerage statements or descriptions of past performance, but such items are not indicative of future results or performance, or any representation, warranty or guaranty that any result will be obtained by you. These results and performances are NOT TYPICAL, and you should not expect to achieve the same or similar results or performance. Your results may differ materially from those expressed or utilized by Gann Explained LLC due to a number of factors. Individual results will always vary and the assumption should not be made that past performance or results, testimonials will equal or guarantee future results. No profits can be guaranteed and no assurance is made against future losses. Futures, Forex, Stock, and Cryptocurrency trading involves considerable risk and should only be attempted by those in the proper learned financial condition who are able to assume the inherent risk involved. Gann Explained LLC and the trainer disclaim any liability, loss, or risk resulting directly or indirectly, for the use or application of any of the content of our trading signals, alert, tips, analysis, trade setups, newsletter, videos, books or courses, regardless of whether those decisions were inspired by using this site or not. It is up to the individual to do the research or past performance of any system they use to trade with and the user also acknowledges that Gann Explained LLC is no way responsible for the investment and trading and/ or legal decisions of its users.

.png)

The Result Driven W.D. Gann Academy